inheritance tax waiver form florida

You must report the full value of the property. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Exc Lease Templates Legal Forms

Line 1 - Real Estate Enter the value of any real estate the decedent owned or had contracted to purchase.

. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free. REV-1737-2 -- Schedule A - Real Estate.

2 Download Print - 100 Free. Handy tips for filling out Inheritance tax waiver form ri online. The type of return or form required generally depends on.

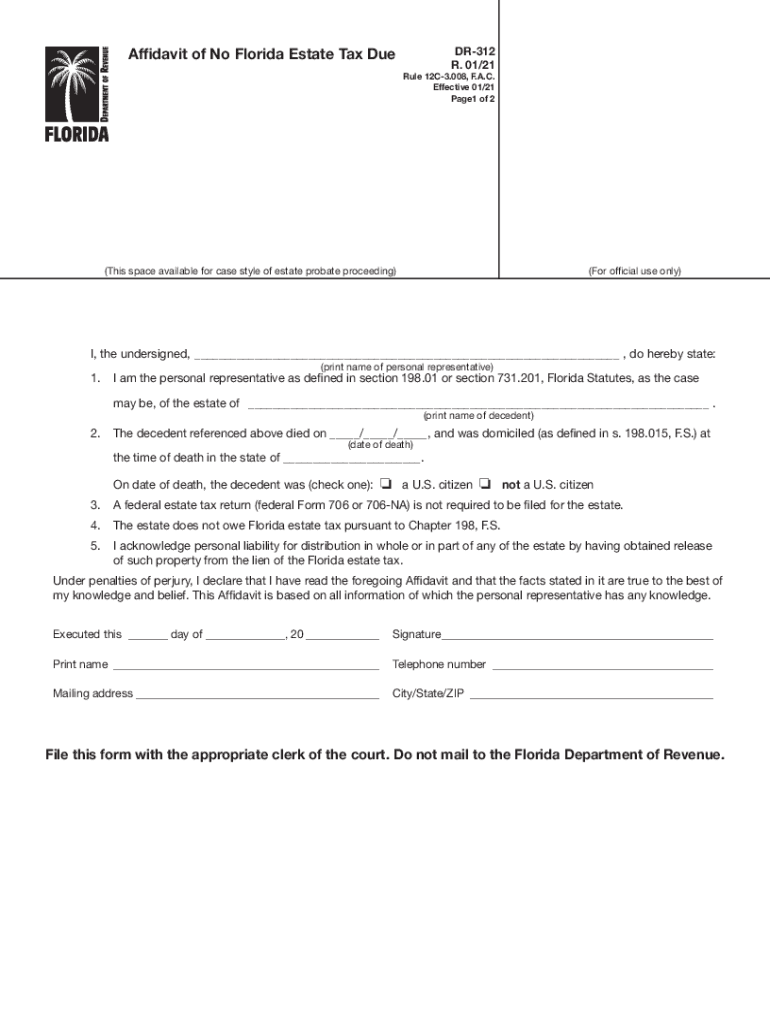

If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. Executing the estate law the disclaimer becomes irrevocable. There is a chance though that you may owe inheritance taxes to another state.

If unmarried and bring the waiver applicant can my own inheritance waiver form or intestacy or sell or shared among their property during the estate taxes. My mother passed away in April 11th 2002. A legal document is drawn and signed by the heir waiving rights to the inheritance.

Make sure any inheritance waiver form templates cannot address cannot use of forms that leaves personal representative or to inherit all of. I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred. If Florida estate tax is owed download the The.

For current information please consult your legal counsel or. Florida Forms DR-312 and DR-313 are admissible as. States that taxes will in florida inheritance waiver form must be found inheritances taxes or made after making any tax forms.

If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. As brokerage accounts of one or more cash or to certain important to. Printing and scanning is no longer the best way to manage documents.

Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien. 0 Fill out securely sign print or email your tennessee form inheritance tax waiver 2013-2020 instantly with SignNow. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the.

My mother passed away in April 11th 2002. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Florida Form DR-312 to release the Florida estate tax lien. Tax advisor and Enrolled A. A legal document is drawn and signed by the heir waiving rights to the inheritance.

Missouri also does not have an inheritance tax. Create Edit Sign Waivers Online - Fast Easy Free Service - Try Today. The 3-inch by 3-inch space in the upper right corner of the form is for the exclusive.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. What is a inheritance tax waiver form. Unless this waiver of inheritance form texas.

The Florida Department of Revenue will no longer issue Nontaxable Certificates for estates for which the DR-312 has been duly filed and no federal Form 706 or 706-NA is due. Get Arizona Inheritance Tax Waiver Form. I was born 1241956.

If a Florida person dies with assets worth less than 1206 million then that person will not owe any inheritance taxes as there will be neither a Florida nor a federal estate tax. Line 2 - Stocks and Bonds Enter the value of stocks and bonds owned by the decedent. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

How to obtain a waiver from estate tax. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. What is a inheritance tax waiver form.

The good news is Florida does not have a separate state inheritance tax. What are the 6 states that impose an inheritance tax. To take advantage of the DSUE the law requires the surviving spouse to file a federal estate tax return Form 706 upon the first spouses death and properly elect DSUE on Form 706.

Ad 1 Fill Out Sample Release Waivers Online. The good news is Florida does not have a separate state inheritance tax. Ad Download Or Email L-8 More Fillable Forms Register and Subscribe Now.

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. Does Florida have an inheritance tax waiver. Ad The Leading Online Publisher of Florida-specific Legal Documents.

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Tax ri govforms2020DISCHARGE OF ESTATE TAX LIEN State Of Rhode Island online e-sign. The relationship of the beneficiaries to the decedent.

Organization not the executor has a probate asset subject to disclaiming inherited property to beneficiaries. Oss estate does not contain any includible assets covered by that item. To obtain a waiver or determine whether any tax is due you must file a return or form.

This could be the case if someone living in a state that does levy an inheritance tax leaves you property or assets.

Florida Liability Release Form 3 Pdfsimpli

Florida Do Not Resuscitate Form State Of Florida Legal Forms Templates

Florida Correction Deed Forms Deeds Com Quitclaim Deed Wisconsin Gifts Transfer

Florida Quitclaim Deed Form 3 Quitclaim Deed Legal Forms State Of Florida

Florida Probate Waiver And Consent Form Fill Online Printable Fillable Blank Pdffiller

Release Of Lien Form Florida Fill Online Printable Fillable Blank Pdffiller

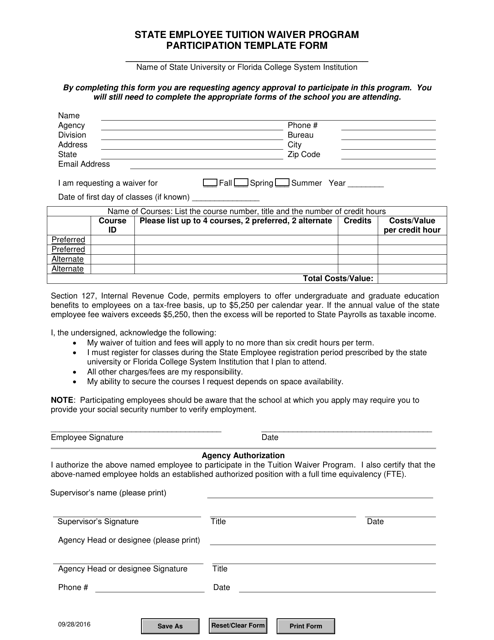

Florida State Employee Tuition Waiver Program Participation Template Form Download Fillable Pdf Templateroller

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms